Editor’s Note: The following is Part 1 of my 2 part series “The Freelancer’s Guide to Managing Your Money in the ‘Gig Economy’ (and Surviving Global Pandemics).”

Here’s → Part 2: How to Generate Income (Even If You Can’t Find Work)

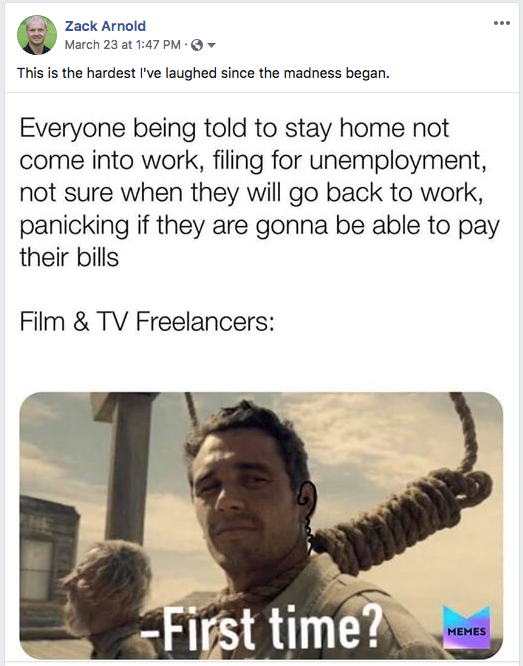

There’s something about global pandemics that brings every meme imaginable out of the woodwork. I get it – we all need a little bit of humor to counteract the paralysis we’re collectively experiencing as we watch the economy implode from our living rooms.

I’m personally not much of a meme-sharer. But I gotta admit that after seeing this image of James Franco from The Ballad of Buster Scruggs I couldn’t resist…

Having worked as a freelancer in the Hollywood ‘Gig Economy’ since 2005, I haven’t had a job that lasted for more than seven months straight in fifteen years (gigs for me last anywhere from 1-2 weeks to 4-5 months per job). I’m used to the ‘feast or famine’ cycle of project-based jobs and have never had the opportunity to live ‘paycheck to paycheck’ working full-time. But there’s a HUGE chasm of difference between having some money set aside for the ‘leaner months’ as opposed to facing virtually no income for the foreseeable future.

If you’ve been a freelancer for most of your career, you might have a few months of cash set aside right now…yet the gig you hoped would get you back on your feet disappeared into thin air.

Or perhaps you’ve already drained much of your emergency funds and you just got back to work in the last few weeks…until the rug was pulled out from under you and you’re left with barely any of your ‘war chest’ remaining.

Or you might be in the position where you are indeed living paycheck to paycheck with no backup cash, and just reading this sentence induces panic since there is no safety net to save you.

Rest assured that no matter your current level of financial preparedness (or lack thereof), you are not alone. Shockingly, very few have prepared for an unexpected lapse in income, freelance or otherwise. People are so ill-prepared for financial emergencies that according to a Federal Reserve survey1:

40% of American adults can’t cover a $400 emergency with cash, savings, or a credit-card charge they could pay off quickly.

Want to know something even more depressing? That Federal Reserve survey was released in 2019 during the most prolific decade of our modern economy.

A lot has changed since 2019 my friends.

Welcome to Our New Reality

As of writing this article, 10 million people (10 MILLION!!!!) have applied for unemployment benefits in the last two weeks2, setting two back-to-back weekly records of 6.6 million last week and 3.3 million the week before, a staggering increase from the previous record of 695,000 claims filed the week ending October 2nd, 19823.

Wait for it…

If you’re a freelancer in the entertainment industry like me, there’s a 95% chance you are unemployed4. Even worse, the remaining 5% who are still employed will likely run out of work as soon as current projects are finished and delivered.

We’re staring down the barrel of nearly a 100% unemployment rate in Hollywood, and the chances of there being any sustainable work for us in the near future are slim to bupkis.

We’re staring down the barrel of nearly a 100% unemployment rate in Hollywood…

No matter your present financial circumstances, it’s time to accept that things aren’t going back to “normal” anytime soon, and you need a financial plan to weather this storm.

If organizing your money terrifies you right now…if the thought of putting together a spreadsheet that outlines your grim financial reality pushes you into a downward spiral of anxiety or depression…here are five simple practices to help you reduce pandemic panic.

Priority #1 is managing your mental health and taking care of you.

If you feel alone right now and need a friendly reminder you’re in this with many others just like you, here’s a recent Zoom call with my coaching & mentorship community discussing our collective financial challenges.

If you’ve taken a deep breath (or fifty) and you’re ready to roll up your sleeves, let’s take the first step to regaining control over your financial situation.

If you wanted to change your lifestyle habits, improve your diet, and lose some weight…this is where you’d be forced to write a journal of everything you eat TODAY. (Yup…even the Oreo’s for lunch and the Cocoa Puffs for dinner last night.)

This is the journey into self-awareness that terrifies so many…but you cannot improve your situation until you understand your current circumstances.

No matter where you are right now (or how badly you want to hide from everything), let’s paint a clear picture of your CURRENT financial reality.

Part I: Creating Your ‘Triage Budget’

and Understanding Cash Flow

Your ‘Triage Budget’ is exactly what it sounds like: Your patient is dying on the table and you need to stop the bleeding – fast.

Like everyone else, when the pandemic first hit I went into full-blown panic mode.

As I watched one Hollywood production after another get shut down in a matter of days like ducks getting murdered in a shooting gallery, I visualized my bank account rapidly draining to a zero balance, my family going hungry, and my kids sleeping on cots in a homeless shelter. Whether or not these catastrophized images were warranted or imagined, the anxiety was real. Yet all it took was just two hours of me sitting down with this Google Sheet Budget Template to alleviate 98% of my anxiety.

Once I ran through the steps outlined below to identify my ‘Sleep Easy’ number, I knew TO THE DAY when I would run out of money (assuming worst-case-scenario I earned ZERO income for the foreseeable future…which is quite possible).

Having a much clearer picture of my monthly cash flow and how much ‘Runway’ I had to support my business and my family allowed the space in my brain to take a deep breath, realize things weren’t nearly as bad as I imagined, and prioritize a plan of attack.

Step 1: Calculate Your ‘Essentials’ (Your FIXED Expenses)

To put it simply, your ‘Sleep Easy’ number is the minimum amount you need in your bank account to cover an entire month of your “Essential” (yup, there’s that word again) FIXED expenses that allow you to maintain basic necessities – food, water, shelter, insurance, and so on.

Unlike many budgeting processes where you add up everything you’re spending now from the top down, we will instead take a bottom up approach.

You are going to build from the most foundational expenses you must pay (e.g. your mortgage or rent, electric bill, etc) and slowly stack on your remaining expenses from most to least important.

This is about finding the sweet spot between extravagance and poverty. I call it my ‘Sleep Easy’ number because even though it might be uncomfortable losing some optional services, monthly subscriptions, or luxuries, I can still sleep easy knowing my family is taken care of (and we won’t go insane staring at the wall living off Ramen noodles for the next 6 months).

Your most essential items will likely include:

- Mortgage/Rent

- Auto payments

- Auto Insurance

- Health Insurance (or union dues that serve as your premiums)

- Home Security

- Home/Renter’s Insurance

- Credit card payments

- Student loan payments

- Electric and/or Water Bill

- Gas Bill

- Internet

- Cell Phones

Working from the bottom up to identify your most essential monthly bills & utilities gives you the first rough draft of your ‘Sleep Easy’ number (or more accurately your ‘I Don’t Want to Sleep On the Sidewalk’ number).

If you’re wondering what to do with all those monthly subscriptions, gym memberships, your cable bill, streaming services, etc etc etc…we’ll get there. I’m not asking you to cancel everything in your life and live like a Buddhist monk until the world stops losing its shit.

At this point you simply have a clearer picture of how much you MUST spend on a monthly basis for basic survival.

Step #2: Cancel, Negotiate, or Defer Every Possible Payment

Now that you’ve slimmed down to prioritizing only your ‘Essential’ monthly bills…it’s time to slash and burn even further. Run through every item on your list and identify which of these payments can be deferred given present circumstances.

Because things are changing so rapidly I’m hesitant to link to specific federal or state-by-state government incentive programs, but after doing a bit of your own research you’ll probably find that if you qualify based on your current financial circumstances, you can:

- Defer your mortgage or rent for up to 90 days (or more)

- Pause your car payments

- Negotiate a lower rate for your auto/home insurance

- Defer credit card payments (or negotiate reduced rates)

- Defer student loan payments

- Pause essential monthly subscriptions

- Inquire about deferring subscription payments (many companies are already offering months of their premium services for free)

In less than an hour with a little bit of due diligence and research (and without making a single phone call), I was able to reduce my monthly budget by over 40%.

I literally cancelled over $1000/month of car payments with three clicks on my First Entertainment Credit Union account home page.

That’s like losing 25 pounds simply by sneezing.

Having been in substantial six-figure debt during the 2009 housing crisis, I can attest firsthand that during a crisis banks want to get paid something more than nothing…and you have TONS of room to negotiate.

If you’re utmost concern is renegotiating credit card debt, late fees, and interest rates, the best resource I can recommend that completely changed my financial life is I Will Teach You to Be Rich by NYT bestselling author Ramit Sethi.

And here’s a great article about how to negotiate your rent (a tactic that works even when the world isn’t falling apart).

Yes I know it’s a headache to potentially sit on hold forever dealing with your banks, credit card companies, landlords, and various lenders listening to Jazz Muzak on an endless loop.

This process is going to SUUUUUUUUUUUCK…I get it.

But if putting in a few hours (or even a day or two) of due diligence saves you hundreds or even thousands of dollars over the next several months, that time is extremely well spent.

Once you’ve slashed and burned your ‘Essential’ budget you now have the LEANER version of your ‘Sleep Easy’ number.

Step #3: Reprioritize Your TRUE Needs and Trim Your VARIABLE Expenses

Step three of managing your finances to weather both the lean months and global pandemics alike is to have a ‘Come to Jesus’ conversation with yourself and your immediate family. How ‘Essential’ are your remaining monthly expenses?

- How important is it to have access to ALL of your various streaming subscriptions? (If you have kids to entertain, a couple might belong in the ‘essential’ category…I get it).

- Is now the ideal time to cut the cord all together on cable/satellite?

- Are there downgraded ‘freemium’ versions of certain apps or subscription services you can do without or develop workarounds for?

- How necessary is it to order takeout or maintain the gym memberships you’re not using? (although if you have the means right now, please make an effort to support your local businesses).

- How badly do you need to fund various savings accounts like vacation funds, your kids’ upcoming summer camps, or holiday presents you won’t buy for 8 more months? (NOTE: If you’re anxious about cutting off auto-funded savings accounts because you fear you might never start them again…keep funding them.)

- How badly do you need to eat 100% grass-fed organic beef?

- How much do you really care about drinking from cheap plastic instead of expensive glass bottles?

- How important is it to have Paleo-friendly mayo instead of Miracle Whip?

- Can you substitute that Heineken with a Pabst Blue Ribbon? (sorry…couldn’t resist)

Yes, these are all difficult conversations.

Fortunately for now I’m in a financial position where I can avoid living off Miracle Whip and Wonder Bread, we can still subscribe to our favorite streaming services, and I can continue to fund our kids’ college funds (for the time being). But if I was strapped for cash and staring down the barrel of going bankrupt, every single one of these items would mercilessly get cut from my budget.

This is all about SURVIVAL.

This process isn’t about maintaining your current comfort level and enjoying the pandemic from the comfort of your living room. This is all about SURVIVAL.

Once you’ve eliminated as much dead weight from your monthly budget as possible by both cutting expenses and deferring payments (or if you have a high pain tolerance for racking up missed payments for a while), you now have your true ‘Sleep Easy’ number for any given month.

ESSENTIAL EXPENSES

(-) DEFERRED/REDUCED PAYMENTS

+ REMAINING EXPENSES

= YOUR MONTHLY ‘SLEEP EASY’ NUMBER

Step #4: Calculate Your Remaining ‘Runway’

I find it’s pretty common for most people to have a basic monthly budget. While they may or may not stick to it diligently, they have a rough idea of what they bring in and what they spend.

What very few people have, however, is a clear picture of their monthly cash flow. In the tech world this is known as how much ‘Runway’ you have (i.e. how far your plane can go before it crashes into the Potomac).

Do you know how many months you can maintain your current lifestyle if you earn ZERO income but continue paying your monthly expenses?

Thanks to this simple Google Sheet template I can tell you TO THE DAY when I’m going to run out of money and no longer be able to pay my basic living expenses.

To calculate your remaining financial runway, simple do the following:

- Add up all available cash you have on-hand or can liquify (including any emergency funds, retirement funds you’re willing to dip into, etc)

- Determine your ‘Sleep Easy’ number by calculating all of your basic living expenses (as outlined above)

- Divide cash-on-hand by your ‘Sleep Easy’ number to determine how many months you can maintain your current lifestyle without additional income

HERE’S AN EXAMPLE:

Cash-on-hand (bank accounts, emergency funds, etc):

$20,000

÷

‘Sleep Easy’ monthly expenses:

$5,000/month

=

Your existing runway (with no income):

4 MONTHS

At this point you’re either feeling a little better about how much time you have available to you before the next paycheck needs to hit your bank account…

…or you’re FREAKING. OUT.

Luckily this is just the beginning of this process. Because of the various government programs available to all of us (specifically freelancers in the creative field), there are a lot of options to generate fairly substantial income and buy yourself several additional months of well-being before you need the next real paycheck.

I cover all of the various options for generating income in Part 2 of this series (publishing soon).

Take Back Control Of Your Finances…

I know how easy it is to allow your thoughts to spiral out of control and conjure up worst-case-scenarios in your head that include starving children, evictions, and homeless shelters, but the likelihood is extremely high that you are far from this point. And you have a lot of options to take back control of your financial situation.

Prioritize a few hours to block out all of the distractions and interruptions in your life (especially the news) and focus on:

- Calculating Your ‘Essentials’ (i.e. Your FIXED Expenses)

- Cancel, Negotiate, or Defer Every Possible Payment

- Reprioritize Your TRUE Needs and Trim Your VARIABLE Expenses

- Calculate Your Remaining ‘Runway’

If you need help better organizing your monthly expenses, trimming down to your ‘Sleep Easy’ number, and calculating your ‘Runway’ so you better understand monthly cash flow click here to download this Google Sheet budget template where I’ve already done the hard work for you.

In Part 2 of this series (publishing soon) I will help you create a plan to generate more income based on the various government incentives available to you (not to mention the endless opportunities to finally start that side-hustle you’ve been thinking about).

In Part 3 of this series (publishing soon) I’ll show you step-by-step how to reorganize your financial workflow so you can fully automate your finances, set money aside for the next emergency (or global pandemic), and rest easy during that next hiatus knowing you’ve bought yourself plenty of time before you need the next paycheck.